Audit Exemption – Does Your Company Make the Cut? (Part 1 of 2)

- wupeicong11

- Aug 29, 2025

- 3 min read

Updated: Aug 29, 2025

This article illustrates the applicability of the “small company concept” for audit exemption for Singapore-incorporated companies which are not part of a group.

The “small company concept” for audit exemption became applicable 10 years ago in 2015. Contrary to the previous concept, a company no longer needs to be an exempt private company (“EPC”) in order to qualify for audit exemption. EPC is a private company which has less than 20 shareholders (individuals) and with no corporate shareholders.

A private company which has corporate shareholders can be exempted from audit if Quantitative Criteria are met.

Single Company

According to the “small company concept”, a company can be exempted from audit if it is small. A company is considered small if:

it is a private company during the financial year; and

Quantitative Criteria: for the immediate past 2 consecutive financial years, at least 2 of the following 3 criteria are met:

- Annual revenue ≤ S$10 million

- Total assets ≤ S$10 million

- Number of full-time employees as at the end of the financial year ≤ 50

If the current financial year is FY2X23, the immediate past 2 consecutive financial years are FY2X21 and FY2X22.

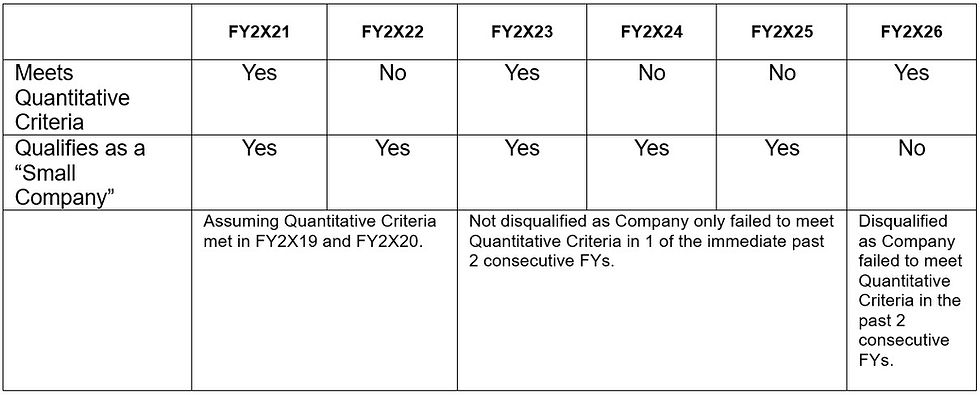

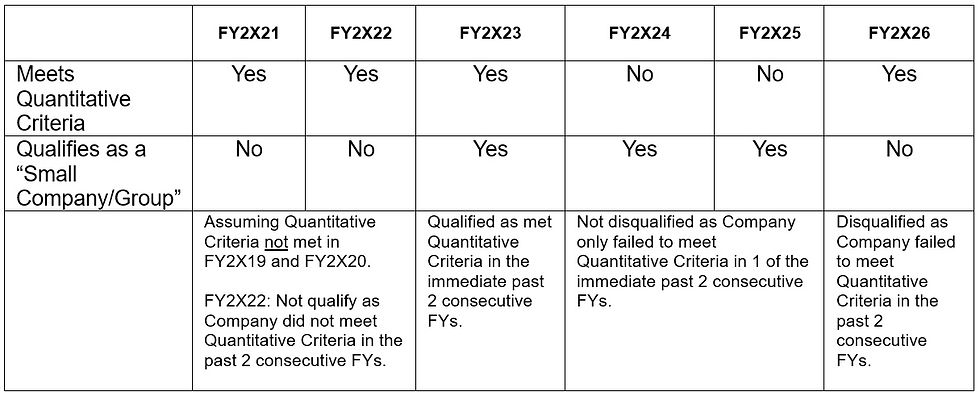

Quantitative Criteria – Continuing Qualification

Where a company has qualified as a small company, it continues to be a small company until it is disqualified. A company is disqualified and not considered small if:

a) It ceases to be a private company at any time during a financial year; or

b) it fails to meet the Quantitative Criteria for the immediate past 2 consecutive financial years.

Existing Company (Example 1):

Existing Company (Example 2):

New Company (Incorporated in FY2X21):

A new company qualifies as a “small company” if it is a private company and meets the Quantitative Criteria in its 1st or 2nd financial year after incorporation. If the new company did not qualify in the 1st financial year, it will still get a chance to qualify in its 2nd financial year.